🚦Token Approval Protection

OMNIA's Token Approval Protection secures DeFi traders' funds using our safe RPC Endpoints, halting transactions and providing real-time alerts against malicious tokens.

What is the "approve" call in the Ethereum ecosystem?

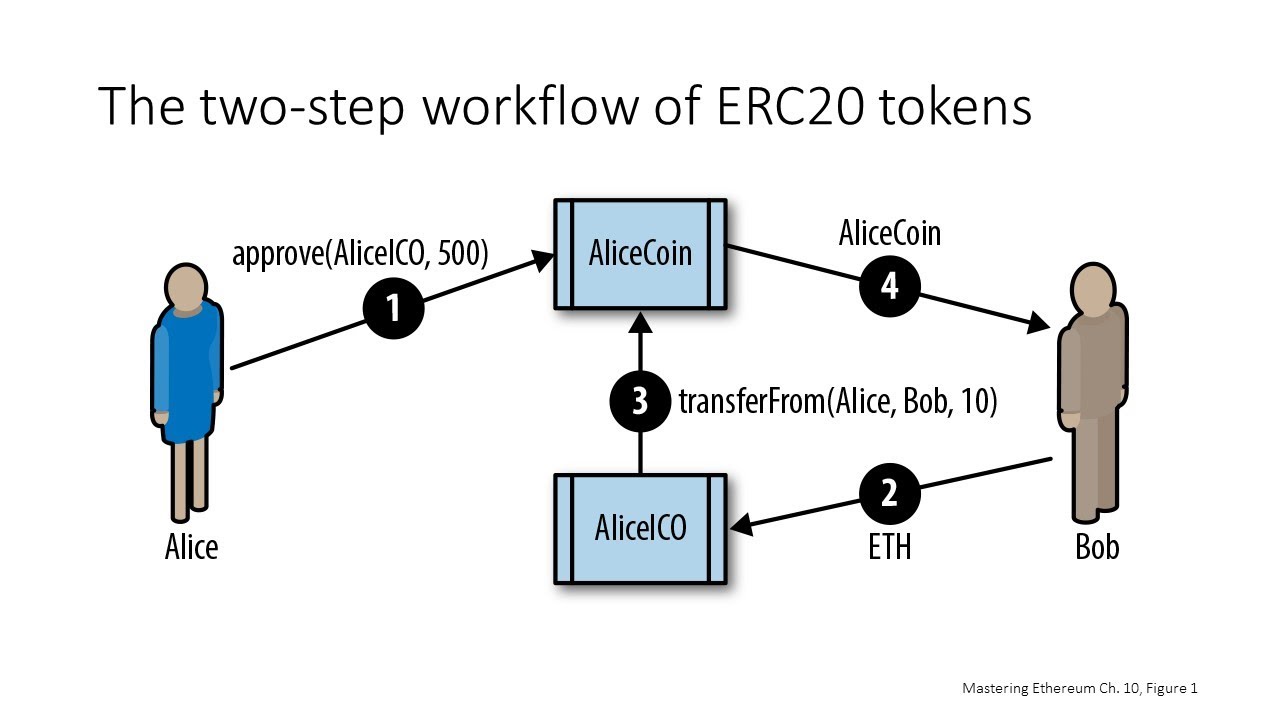

The "approve" function was firstly introduced in the Ethereum ecosystem by the ERC-20 standard and is a pivotal mechanism that empowers token holders to delegate specific spending permissions to other addresses, referred to as "spenders." When a token holder (wallet user) initiates this function, they specify two crucial parameters: the address of the designated spender and the maximum number of tokens that the spender is permitted to transfer on their behalf.

Approve use-cases

One of the most common use cases is for decentralized exchanges (DEXs) like Uniswap and SushiSwap. When a user wants to provide liquidity or trade tokens on these platforms, they need to approve the DEX smart contract to spend a specific amount of tokens from their wallet. This approval ensures that the DEX can only access the approved amount of tokens and not the entire balance.

Another common use case is in governance and staking protocols. Users approve smart contracts to manage their tokens for voting, delegating, or participating in governance decisions without transferring ownership. This function helps maintain security and control over users' assets while enabling various DeFi and DApp interactions on the Ethereum blockchain.

Since then, the approve function was added to two additional standards: ERC-721 (NFT) and ERC-1155 (Multi-token). For NFTs, the function allows the designated spender to transfer the specified token (NFT) on behalf of the owner.

During the execution of the "approve" function, several critical checks are conducted to ensure the security and integrity of the transaction. Firstly, the smart contract governing the ERC-20 token verifies that the token holder has sufficient balance to cover the approved amount, preventing any overspending that could lead to an imbalance in the system.

How does OMNIA protect you?

Furthermore, security checks are carried out to scrutinize the spender's address for any involvement in malicious activities. This includes evaluating whether the spender's address has been linked to phishing attempts, blackmail, token theft, money laundering, or financial crimes. Additionally, the transaction checks whether the token in question has been associated with individuals or entities listed on the U.S. Office of Foreign Assets Control (OFAC) sanctions list, aiming to prevent any interactions with sanctioned entities.

Critical Risks for DeFi Traders, mitigated by OMNIA

Here's a brief summary of how each of these activities can affect a DeFi trader:

Phishing: Phishing attacks can trick traders into revealing sensitive information or private keys, leading to unauthorized access to their assets and potential loss of funds.

Blackmail: Blackmail schemes can coerce traders into making payments or sharing private information, putting their financial security at risk.

Stealing: Theft of tokens can result in a direct loss of assets, impacting a trader's portfolio and overall financial stability.

Money Laundering: Involvement with money laundering can lead to legal repercussions, potentially freezing or confiscating a trader's assets and restricting their ability to trade.

Financial Crime: Participation in financial crimes can also result in legal consequences and damage a trader's reputation within the cryptocurrency community.

US OFAC International Sanctions: Traders dealing with tokens associated with individuals or entities on the OFAC sanctions list may face legal issues, asset freezes, and difficulties in conducting transactions with certain counterparties, limiting their trading opportunities and financial freedom.

These robust security measures surrounding the "approve" function not only protect token holders from potential misuse of their assets but also help maintain the integrity of the broader cryptocurrency ecosystem, promoting trust and safety for all participants in the DeFi trading space.

Transaction halting and notification system

In the event that any of these checks fail, the transaction is halted, and an HTTP 514 error is returned by the OMNIA RPC endpoint, signaling a potential security issue. A security notification is promptly dispatched to the relevant parties. To receive these critical security notifications, users are encouraged to configure their notification settings within our Dashboard.

Supported networks

Ethereum (ChainID 1)

Binance Smart Chain (ChainID 56)

Optimism (ChainID 10)

Polygon (ChainID 137)

Fantom (ChainID 250)

Avalanche: C-Chain (ChainID 43114)

Arbitrum (ChainID 42161)

Types of protected assets

Fungible tokens as described by the ERC-20 standard

NFTs as described by the ERC-721 standard

Tokens (fungible and/or non-fungible) as described by the ERC-1155 standard

Last updated